Analysis of a Pandemic-Induced Metals Market

The metals market was significantly impacted by the COVID-19 pandemic. The fear, uncertainty, and doubt (FUD) led to sharp decline in consumption. Much of the metal processing production was curbed to meet this new demand. Metal inventories swelled, causing the prices to plummet. Distributors brought their inventory levels down considerably to mitigate the risk of an additional decline in demand, further reducing prices. Metal pricing hit rock bottom around the April to May timeframe and quickly rebounded. A surge in home office and learning products sales coupled with increased consumer confidence due to stimuli packages help spawn a quicker than anticipated recovery. Countries like China and Vietnam managed the virus quickly and worked to build manufacturing capacity to pre-pandemic levels. As demands picked up significantly, manufactures reluctantly started to increase the manufacturing and processing of raw materials. The depleted inventories, reduced capacity, and increase demand have caused a perfect storm in the market, pushing prices to the upper echelons. We’ll review the supply, demand, and other market conditions to see what 2021 will bring to us, looking at 3 metals: Copper, Aluminum, and Steel.

Supply

Ore Production

Copper

Copper conducts heat and electricity very well, making it a very useful material, especially for electronics. Chile (28.5%) and Peru (11%) represent almost 40% of the worlds copper ore mining (Basov, 2021) . Combined production was 4% less in 2020 than in 2019. The reduction in supply has brought copper inventories down to a 15-year low on the London Metal Exchange. Inventories are expected to plummet further as there is a projected rise in demand of 5% in 2021 and only a supply growth of 2.3%, leaving about a 200,000 ton deficit (Northern Miner Staff, 2021) . Supply for copper could see similar difficulties in all of 2021 as both countries continue to battle with the pandemic.

Aluminum

Aluminum is lightweight, corrosion resistant, conductive, and durable, making it a desirable material is the electrical component space. Luckily, bauxite, the raw material containing approximately 50% aluminum oxide, is plentiful, allowing for many different countries to produce aluminum. Approximately 1/3 of the world’s supply of bauxite comes from Australia. China is the next largest supplier representing about 20% of the world’s bauxite production (Profiling the top five bauxite producing countries in the world, 2021). Overall, bauxite mining was only marginally impacted by COVID-19. Some of the smaller producing counties faced difficulties (Hall M. , 2020).

Steel

Known for its versatility, low cost, and recyclability, steel has found its way into the design of many electrical components. Like aluminum (bauxite), Australia is the top producer of iron ore. Again, producing nearly 1/3 of the world’s ore. Brazil is a distant second producing a little over half as much Australia (Top five iron ore producing countries from Australia to Russia, 2020). Supplementing the iron ore extraction is a very robust steel recycling industry.

Processing & Distribution

Smelting is the process in which raw ore material is melted and the base metal is extracted. In anticipation of the downturn caused by COVID-19, many smelters reduced their capacity. In addition, distributors leaned out inventories throughout the 2nd and 3rd quarters of 2020 in anticipation of a continued economic downturn. Production was slow to recover as manufacturers were apprehensive to produce at pre-pandemic volumes. Increased smelting margins have helped incentivize an industry that had recently been under a great deal of pressure to cut costs. In late March 2021 aluminum smelting margins reached historically high levels (Yao, 2021). This will help maintain a steady supply, but at the consequence of additional raw material costs.

Distribution is still frantically trying to fill customer orders. Industry veterans are comparing this pricing surge to the 2008 steel market with one start contrast; everyone is paying a high cost, but in this case, they’re waiting a long time for their material to arrive (Thatcher, 2021). Specialty metals are also seeing a further dilemma. When mills are stretched super-thin like they are now, they will sometimes reduce the number of products offered to better serve core customers, leaving buyers of specialty metals in the dark.

Demand

Copper

Almost half (43%) of copper is used in the building and construction industries. Copper wire and pipes are used to flow electricity and water. The housing industry has seen significant growth due to record low mortgage rates. New home construction and renovations have been consuming millions of pounds of copper this past year. With rates expected to remain low, we could see this trend continue through 2021.

The next largest uses are in electronics at about 20%. The electronics industry will continue to grow as it did during 2020. The number of Netflix, Hulu, and Disney + subscribers are going to need a screen to watch their favorite shows, so I don’t see this industry slowing down. The current semiconductor shortage could throttle down some of this growth in the short-term, but as those shortages are address, we’ll see continued growth in this market as well.

Transportation will see continued growth in demand as well. With the Biden administration getting to work on green initiatives, we’ll see growth in the electrical vehicle markets as well as other clean energy and storage initiatives. A battery electric car uses about 183 pounds of copper vs only about 18-49 with an internal combustion engine (ICE) vehicle. A battery electric bus will use 813 pounds of copper (Copper Drives Electric Vehicles). When you start to scale these up, it is easy to see just how much of an impact the clean energy initiative could have on the copper demand. These vehicles also require charging stations will further drive consumption.

Aluminum

Aluminum is seeing an increase in demand as well. China, historically known for being a net exporter of aluminum, was a net importer of aluminum in 2020. This was the first time since 2009 that this has happened. Much of this is driven by stimulus packages enacted by the Chinese government to revive the struggling economy due to the pandemic (Wookey, 2020).The roll out of 5G infrastructures as well as the boom in the EV market will continue to drive demand. If copper prices continue to grow, we could see an additional demand in aluminum as it is used as an alternative material to copper.

Steel

The automobile and white goods industries recovered sooner and stronger than anticipated. Steel demand in 2020 finished out strongly and hasn’t showed any signs of slowing down yet in 2021. In addition to regular demand, distributors are shuffling to increases their inventories. Yes, the same inventories they intentionally depleted last year. Further complicating the situation, original equipment manufacturers (OEM) are placing orders with multiple mills (for the same inventory) in hopes of improving lead times. The OEM will then cancel all available orders once their needs are met. This artificial demand only adds noise to an already chaotic situation and further drives speculation and prices. Mills may adapt a Non-cancelable, non-returnable (NCNR) approach to combat that, but it has yet to be seen. Most expect the steel demand/price bubble to burst sometime later this year. We’ll wait and see just how long these historic prices sustain. The impacts of the Section 232 tariffs have given shelter to US steel producers, allowing them to be more competitive in a market that they hadn’t previously been. The pricing differential between US Midwest and China hot-rolled coil have recently reached an all-time high (Steel spreads analysis: US-China HRC price difference hits historic high, 2021).

Other Price Impacts

South American Elections

Chile and Peru will hold general elections this year. This could lead to some instability in both counties. Peru will hold presidential runoff in June and Chile’s presidential runoff will not be until December. Election results could impact the mining industries for both countries.

Microchip Shortage

The shortage of microchips is causing production shutdowns across various industries. This could have a potential impact across all 3 metals. Manufacturers will order metal materials based on the material availability of microchips. This could help cool these hot metals markets in the short-term. Microchip inventories are slated to recover later in Q3 or Q4, so it will be important to monitor their progress as well as they continue to be a gating factor.

Tariffs

The Biden administration has yet to make it clear its intentions to remove the Section 232 tariffs enacted by the Trump Administration. However, if February’s reinstatement of the United Arab Emirates’ Section 232 tariffs is any indication, they may be around for a while longer. If they are removed it will eliminate a pricing shield that the US steel makers have been behinds since it was enacted.

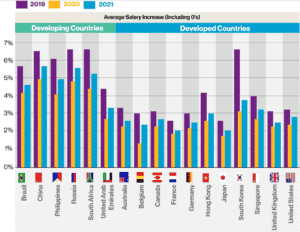

Wages

Nearly 50% of companies globally curtailed pay increases in 2020. Additionally, some companies cut out bonuses and issued reduced cost of living increases. It’s expected that only about 15% of companies will hold off on salary increases in 2021. For those that do administer cost of living increases, they’re expected to range from about 2.5% for developed countries and 6% for undeveloped countries (Ashwanden, 2021). The chart shown below shows projected cost of living increases for the listed countries.

Source: https://www.willistowerswatson.com/en-US/Insights/2021/01/pay-trends-for-2021

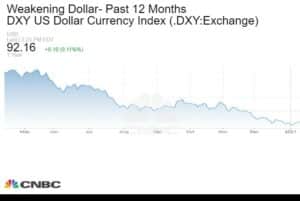

Weakening US Dollar (USD)

With the noise of US Federal Reserve’s money printers still echoing from 2020, we have seen a devaluation of the USD. While the cash influx helped grow the housing and stock markets, its long-term impact is starting to be felt. The USD currency index (DXY) compares the USD to 6 other currencies, giving an overall outlook on the USD’s strength, or in this case, weakness. It has declined about 8% over the past 12 months. The chart below shows the last 12 months of the index. Talks of a fourth stimulus package by the Biden Administration could drive the index down even further, as it is dangerously close to a 7-year low already.

Source: https://www.cnbc.com/quotes/.DXY

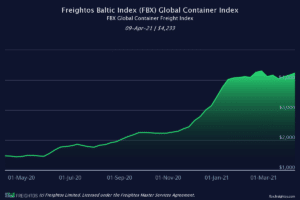

Shipping

Freight charges are on the continued rise as well. The Global Freight Index has risen from below $1,500 in April of 2020 to over $4,000 in April of 2021. The index considers the 12 major ocean freight lanes and price to ship a standard 40-foot, non-refrigerated container. Prices from East Asia to the West Coast of the United States have increased to almost $5,200 as of 4/9/2021, significantly impacting total landed costs for products.

The recent grounding of the container ship Evergreen also impacted shipping capacity. Approximately 30% of all Asia to North America-East coast container ships travel through the Suez Canal, which was blocked by the Evergreen from March 23rd-29th (Coronavirus & Shipping: Air and Ocean Freight Delays, Rates & Cost Increases, 2021). This further strained an already fragile industry. Container ships continue to gather offshore, waiting tirelessly to be unloaded at their destination port. The lack of shipping capacity and extended lead times have forced some companies to air freight goods. This not only comes with a much higher cost, but increased demand has also caused air freight charges to swell.

Overview

Copper

Prices will continue to fluctuate as supply and demand try to find a balance. Demand will continue throughout 2021 with the growing markets. The supply will continue to have limitations due to COVID-19 restrictions and the implementation of vaccines. The projected cost of copper is expected to average out at the $3.50/LB mark, an increase of about 17% over previous projections (Copper price to rise in 2021: analysts, 2021). However, volatility in the market and the weakening USD could drive that number higher. Those bullish on copper are whispering of a potential supercylce, or an extended period of strong demand, that could catapult prices to new all-time highs. The supercycle could be an unintended consequence of green energy initiative. We’ll have to continue to monitor all the external factors impacting the copper industry.

Aluminum

Aluminum prices are expected to stabilize later in the year. Given the breath of bauxite mining across many different regions, I expect this to behave the most predictably of the 3 metals. We’ll see continued demand due to changing infrastructures and green energy initiatives. Aluminum averaged about $1,700/ton in 2020. Pricing for 2021 will depend on how long the demand surge continues. As you recall, smelters are enthusiastically smelting aluminum right now as they continue to cash in on the shortages. This could help inflate inventories sooner than expected, causing the price to drop to a more palatable price. Fitch Solutions has an estimated price of $1,850/ton, or about a 20% reduction from current prices and a almost 8% increase over last year’s price (Increasing supply from China to cap aluminum price – report, 2021).

Steel

I think steel pricing is the most difficult to predict. The bubble could be coming sooner than later, and maybe not at all. It will depend on how much of the current demand is real and not just OEMs playing mills against each other to improve delivery times. The Section 232 tariffs will also paly an important role in the pricing of steel in 2021. One thing is for sure, everyone from a supply side is scrambling to cash in on these historically high prices. The microchip shortages could help keep steel prices in check for the short-term. OEMs will have to patiently wait until prices relax and become more affordable, if possible.

Overall

In the short-term we expect continued volatility as the supply chain continues to play catch up to the demand. Lead times for materials will continue to grow in the short-term as well. Inflated shipping costs will hopefully take the same path downwards. Pricing relief is slated to come in the second half of the year as the supply should catch up with the demand. Most analysts are expecting prices to continue to taper off throughout the remainder of the year. External factors will continue to have an impact on overall prices. We’ll continue to monitor them to keep a pulse on the market.

References

Ashwanden, M. (2021, January 8). Pay trends for 2021. Retrieved from Willis Towers Watson: https://www.willistowerswatson.com/en-US/Insights/2021/01/pay-trends-for-2021

Basov, V. (2021, February 15). Chile was the largest copper producer in 2020; top copper countries felt impact of the pandemic – report. Retrieved from Kitco: https://www.kitco.com/news/2021-02-15/Chile-was-the-largest-copper-producer-in-2020-top-copper-countries-felt-impact-of-the-pandemic-report.html

Copper Drives Electric Vehicles. (n.d.). Retrieved from Copper.org: https://www.copper.org/publications/pub_list/pdf/A6191-ElectricVehicles-Factsheet.pdf

Copper price to rise in 2021: analysts. (2021, January 18). Retrieved from S&P Global: https://www.spglobal.com/platts/en/market-insights/latest-news/metals/011821-copper-price-to-rise-in-2021-analysts

Coronavirus & Shipping: Air and Ocean Freight Delays, Rates & Cost Increases. (2021, March 31). Retrieved from Freightos: https://www.freightos.com/freight-resources/coronavirus-updates/

Hall, L. (n.d.). Aluminum. Retrieved from How Products are Made: http://www.madehow.com/Volume-5/Aluminum.html

Hall, M. (2020, August 21). Bauxite supply to be “marginally” affected by Covid-19: GlobalData. Retrieved from Mining Technology: https://www.mining-technology.com/news/bauxite-supply-covid-19/

Increasing supply from China to cap aluminum price – report. (2021, January 26). Retrieved from Mining.Com: https://www.mining.com/increasing-supply-from-china-to-cap-aluminum-price-report/

Northern Miner Staff. (2021, February 23). Copper supply expected to move into deficit in 2021, says StoneX. Retrieved from Mining.com: https://www.mining.com/copper-supply-expected-to-move-into-deficit-in-2021-says-stonex/

Profiling the top five bauxite producing countries in the world. (2021, January 14). Retrieved from NS Energy: https://www.nsenergybusiness.com/news/profiling-the-top-five-bauxite-producing-countries-in-the-world/

Steel spreads analysis: US-China HRC price difference hits historic high. (2021, March 15). Retrieved from S&P Global Platts: https://www.spglobal.com/platts/en/market-insights/latest-news/metals/031521-steel-spreads-analysis-us-china-hrc-price-difference-hits-historic-high

Thatcher. (2021, February 22). COVID’s Effect On Steel. Retrieved from Magazine Construction: https://www.constructionmagnet.com/metal-roofing/metal-roofing-news/covids-effect-on-steel

Top five iron ore producing countries from Australia to Russia. (2020, August 27). Retrieved from NS Energy: https://www.nsenergybusiness.com/features/top-iron-ore-producing-countries/

Wookey, J. (2020, December 30). Viewpoint: Aluminium in overdrive into 2021. Retrieved from Argus Media: https://www.argusmedia.com/en/news/2173153-viewpoint-aluminium-in-overdrive-into-2021

Yao, W. (2021, March 22). Aluminium: Strong smelting margin drives supply growth. Retrieved from ING: https://think.ing.com/snaps/aluminium-strong-smelting-margin-drives-supply-growth